michigan use tax vs sales tax

A sales tax is a fee levied on the sale of certain products and services that is paid to a governing body state or local. Use tax is a complementary or compensating tax to the.

What Transactions Are Subject To The Michigan Use Tax Kershaw Vititoe Jedinak Plc

The use tax is not in addition to the sales tax but rather works in conjunction with it.

. For transactions occurring on and after October 1 2015 an out-of-state seller may be. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into. Use Tax is defined as a tax on the storage use or consumption of a taxable item or service on which no sales tax has been paid.

Michigan has a higher state sales tax than 712 of states. The current state sales tax rate in Michigan MI is 6. Both sales and use tax.

What is the difference between sales tax and use tax. Authorized Representative DeclarationPower of Attorney. The state sales tax on a car purchase in Michigan is 6.

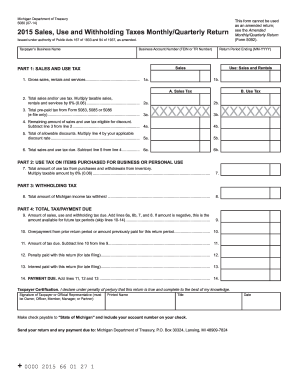

2021 Sales Use and Withholding Taxes MonthlyQuarterly Return. Streamlined Sales and Use Tax Project. Phew that was a lot of information to soak in.

Michigan has a 6 percent sales and use tax rate for retail sales. Use tax is a companion tax to sales tax. Sales of 001 to 010 none 011 to 024.

Individuals and Businesses - Use tax on tangible personal property is similar to sales tax but applies to purchases when Michigan sales tax is not charged. Sales tax applies to sale of tangible personal property to consumers in the State of Michigan. Unlike many other states Michigan does not have county or local sales taxes.

In Michigan certain goods are subject to the 6 sales tax while certain services are subject to a 6 use tax that is imposed on the purchaser or consumer of services for the privilege of using. All tax rates in Michigan are at 6. The underlying concept is that if you bought the product to be used in Michigan then you should pay a use tax to Michigan currently 6 if a sales tax wasnt collected from.

As a result every citizen of the state pays the same 6 sales tax. Certain utilities are taxed at 4 percent. Effective October 1 2018 or after September 30 2018 a remote seller is required to collect sales or use tax in Michigan if in the previous calendar year it.

Consistent with Wayfair effective after September 30 2018 Treasury will require remote sellers with sales. The Michigan use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Michigan from a state with a lower sales tax rate. The Michigan sales tax regula ons give the following brackets for determining the amount of sales tax to be collected.

2020 Sales Use and Withholding 4 and 6 MonthlyQuarterly and Amended MonthlyQuarterly Worksheet. Notice of New Sales Tax Requirements for Out-of-State Sellers. 2021 Sales Use and Withholding Taxes Annual Return.

Michigan is one of the few states that do not have any additional local or county tax. There are a variety of exemptions from the Michigan state sales tax including food prescribed drugs and. Use tax applies to the rental use of.

Michigan Sales Tax Rates. In other words the Court upheld economic presence nexus for sales tax. Use tax of 6 percent must be.

Selling or Ren ng Unit E. Heres a brief recap on the similarities and differences between sales tax vs. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

Michigan first adopted a general state sales tax in 1933 and since that.

78 Sales Tax Use Tax Income Tax Withholding State Of Michigan

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Form 3372 Michigan Sales And Use Tax Certificate Of Exemption

Sales Taxes In The United States Wikipedia

How To File And Pay Sales Tax In Michigan Taxvalet

Michigan Sales Tax Handbook 2022

Michigan Sales Tax Small Business Guide Truic

Are School Supplies Costing You More Michigan Could Pause Sales Tax On Back To School Products Mlive Com

Trugreen Limited Partnership Vs Michigan Department Of Treasury Michigan Supreme Court To Hear Sales Tax Refund Dispute Sal

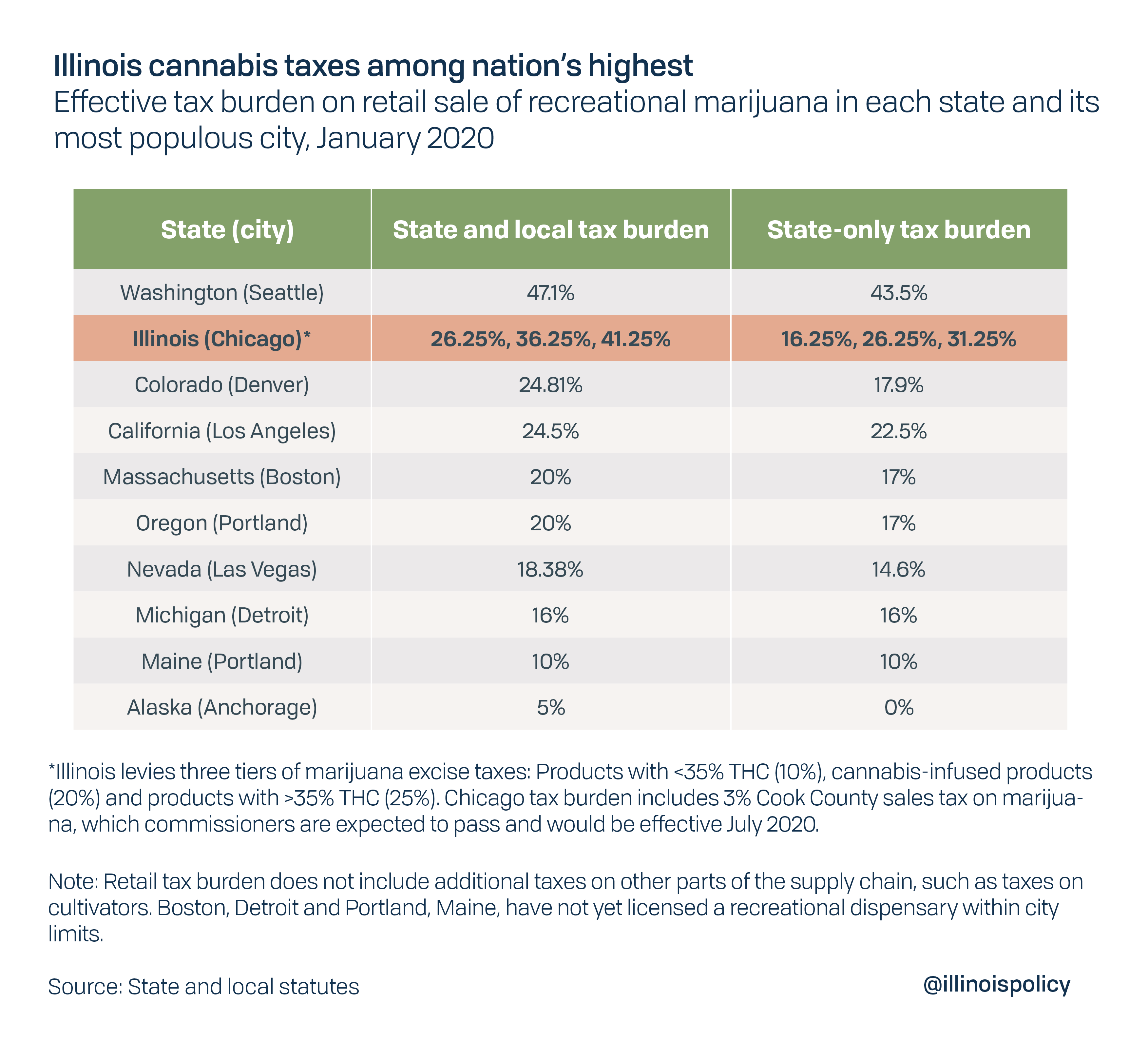

Illinois Cannabis Taxes Among Nation S Highest Could Keep Black Market Thriving

5080 Form 2022 Fill Out And Sign Printable Pdf Template Signnow

Michigan To Enforce Sales Tax On Online Out Of State Retailers

Sales Taxes In The United States Wikipedia

Sales Tax On Grocery Items Taxjar

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

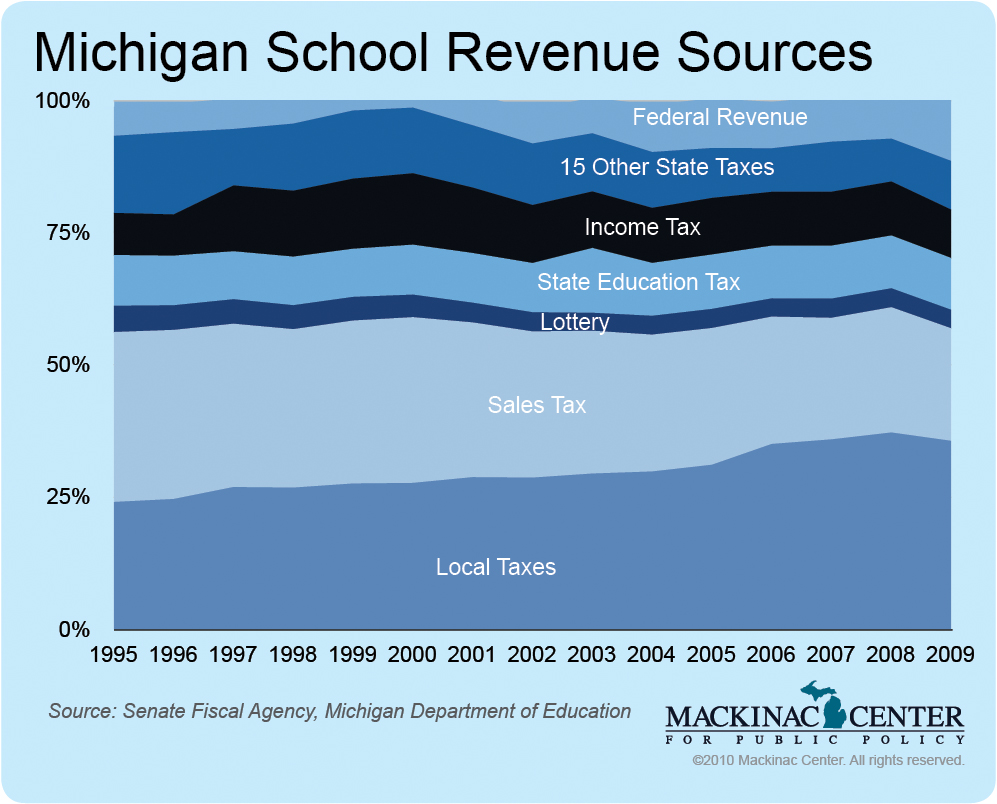

6 The Sales Tax And Lottery Myth School Funding In Michigan Common Myths Mackinac Center

Sales Tax Forms By State Four Seasons Wholesale Tanning Lotion